| Book Code : | 105 |

|---|---|

| Subject Code : | 7110/0452 |

| Author : | M. Nauman Malik |

| Language : | English |

| Publishers : | Read and Write Publications |

Description

105 Accounting O Level Theory and Practice | Read & Write Publications.

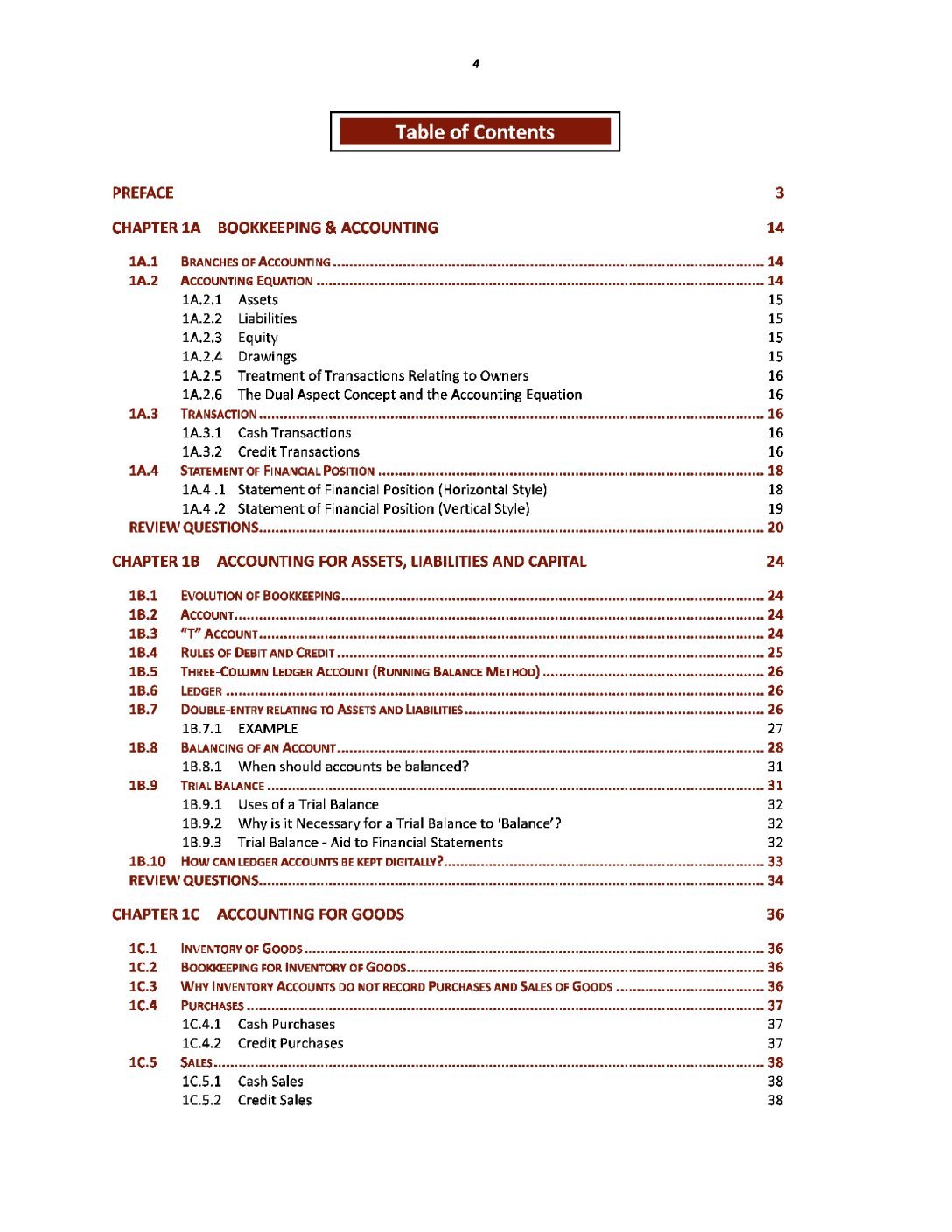

TABLE OF CONTENTS

PREFACE

(105 Accounting O Level Theory and Practice)

CHAPTER 1A BOOKKEEPING AND ACCOUNTING

1A.1 BRANCHES OF ACCOUNTING

1 A.2 ACCOUNTING EQUATION

1A.2.1 Assets

1A.2.2 Liabilities

1A.2.3 Equity

1A.2.4 Drawings

1A.2.5 Treatment of transactions relating to owners

1A.2.6 The Dual Aspect Concept and the Accounting Equation

1A.3 TRANSACTION

1A.3.1 Cash Transactions

1A.3.2 Credit Transactions

1A.4 STATEMENT OF FINANCIAL POSITION

1A.4.1 Statement of Financial Position (Horizontal Style)

1A.4.2 Statement of Financial Position (Vertical Style)

REVIEW QUESTIONS

CHAPTER 1B ACCOUNTING FOR ASSETS, LIABILITIES AND CAPITAL

1B.1 EVOLUTION OF BOOK KEEPING

1B.2 ACCOUNT

1B.3 ”T” ACCOUNT

1B.4 RULES OF DEBIT AND CREDIT

1B.5 THREE-COLUMN LEDGER ACCOUNT (RUNNING BALANCE METHOD)

1B.6 LEDGER

1B.7 DOUBLE-ENTRY RELATING TO ASSETS AND LIABILITIES

1B.7.1 EXAMPLE

1B.8 BALANCING OF AN ACCOUNT

1B.8.1 When should accounts be balanced?

1B.9 TRIAL BALANCE

1B.9.1 Uses of a Trial Balance

1B.9.2 Why is it Necessary for a Trial Balance to ‘Balance’?

1B.9.3 Trial Balance – An aid to Financial Statements

1B.10 HOW CAN LEDGER ACCOUNTS BE KEPT DIGITALLY?

REVIEW QUESTIONS

CHAPTER 1C ACCOUNTING FOR GOODS

1C.1 INVENTORY OF GOODS

1C.2 BOOKKEEPING FOR INVENTORY OF GOODS

1C.3 WHY INVENTORY ACCOUNT DOES NOT INCLUDE PURCHASES AND SALES OF GOODS

1C.4 PURCHASES

1C.4.1 Cash Purchases

1C.4.2 Credit Purchases

1C.5 SALES

1C.5.1 Cash Sales

1C.5.2 Credit Sales

1C.6 PURCHASES RETURNS (RETURN OUTWARDS)

1C.7 SALES RETURNS (RETURNS INWARDS)

1C.8 TRADING SECTION OF INCOME STATEMENT

1C.9 CLOSING OF INCOMES AND EXPENSES

1C.10 CLOSING INVENTORY

1C.11 OPENING INVENTORY

REVIEW QUESTIONS

CHAPTER 1D ACCOUNTING FOR INCOMES AND EXPENSES

1D.1 INCOMES

1D.2 EXPENSES

1D.3 DOUBLE-ENTRY FOR EXPENSES AND INCOMES (REVENUES)

1D.4 BOOKKEEPING FOR INCOMES AND EXPENSES

1D.5 CALCULATION OF NET PROFIT

1D.6 CLOSING OF INCOMES AND EXPENSES

REVIEW QUESTIONS

CHAPTER 2 BOOKS OF PRIME ENTRY

2.1 ADVANTAGES OF MAINTAINING BOOKS OF ORIGINAL ENTRY

2.2 COMPONENTS OF BOOKS OF ORIGINAL ENTRY

2.3 SALES JOURNAL

2.3.1 Posting from the Sales Journal to the Ledger

2.3.2 Trade Discount

2.3.3 Sales on Credit Card

2.4 PURCHASES JOURNAL

2.4.1 Posting from the Purchases Journal to the Ledger

2.5 RETURN INWARDS JOURNAL

2.5.1 Posting from the Returns Inwards Journal to the Ledger

2.6 RETURN OUTWARDS JOURNAL

2.6.1 Posting from the Returns Outwards Journal to the Ledger

2.7 GENERAL JOURNAL

2.8 CASH BOOK

2.9 PERSONAL LEDGERS

2.10 GENERAL LEDGER

REVIEW QUESTIONS

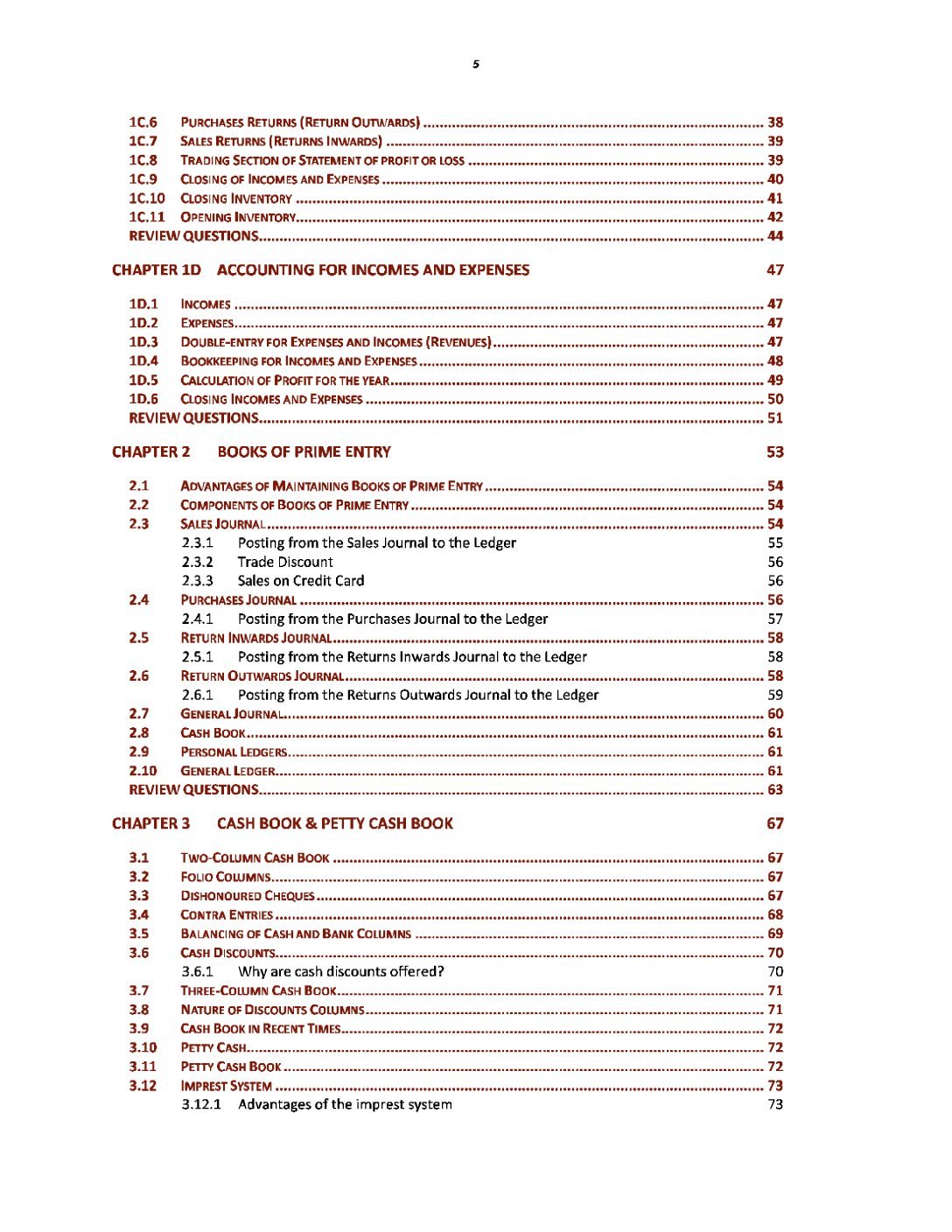

CHAPTER 3 CASH BOOK & PERRT CASH BOOK

3.1 TWO-COLUMN CASH BOOK

3.2 FOLIO COLUMNS

3.3 DISHONOURED CHEQUES

3.4 CONTRA ENTRIES

3.5 BALANCING OF CASH AND BANK COLUMNS

3.6 CASH DISCOUNTS

3.6.1 Why are cash discounts offered?

3.7 THREE-COLUMN CASH BOOK

3.8 NATURE OF DISCOUNTS COLUMNS

3.9 CASH BOOK IN RECENT TIMES

3.10 PETTY CASH

3.11 PETTY CASH BOOK

3.12 IMPREST SYSTEM

3.12.1 Advantages Of the imprest system

3.13 HOW T OAPPLY THE IMPREST SYSTEM

3.14 THE BENEFITS AND LIMITATIONS OF KEEPING CASH AT THE BUSINESS PROPERTY

REVIEW QUESTIONS

CHAPTER 4 BANK RECONCILIATION

4.1 DIFFERENCE BETWEEN BANK STATEMENT AND CASH BOOK

4.2 REASONS FOR DIFFERENCE BETWEEN CASH BOOK AND BANK STATEMENT BALANCE

4.2.1 Items in the Bank Statement but not in the Cash Book

4.2.2 Items in the Cash Book but not in the Bank Statement

4.3 BANK RECONCILIATION STATEMENT

4.4 STEPS FOR PREPARING A BANK RECONCILIATION STATEMENT

4.5 USES OF BANK RECONCILIATION STATEMENT

4.6 IMPACT OF DIGITAL TRANSACTIONS ON BANK RECONCILIATION

REVIEW QUESTIONS

CHAPTER 5 ACCOUNTING FOR NON-CURRENT ASSET

5.1 DEPRECIATION

5.2 CAUSES FOR DEPRECIATION

5.3 FACTORS FOR CALCULATING DEPRECIATION

5.3.1 The Original Cost of Asset

5.3.2 The Estimated Useful Economic Life

5.3.3 The Approximate Residual Value

5.4 CHARACTERISTICS OF DEPRECIATION

5.5 METHODS FOR CALCULATING DEPRECIATION

5.5.1 Revaluation Method

5.5.2 Straight Line Method or Original Cost Method

5.5.3 Reducing Balance Method

5.6 ANNUAL DEPRECIATION UNDER REDUCING BALANCE & STRAIGHT LINE METHODS

5.7 DISTINCTIVE FEATURES OF STRAIGHT LINE AND REDUCING BALANCE METHOD

5.8 DIFFERENCE BETWEEN DEPRECIATION AND PROVISION FOR DEPRECIATION

5.9 DEPRECIATION POLICIES

5.10 DEPRECIATION ACCOUNTING

5.11 DEPRECIATION AND ACCOUNTING CONCEPTS

REVIEW QUESTIONS

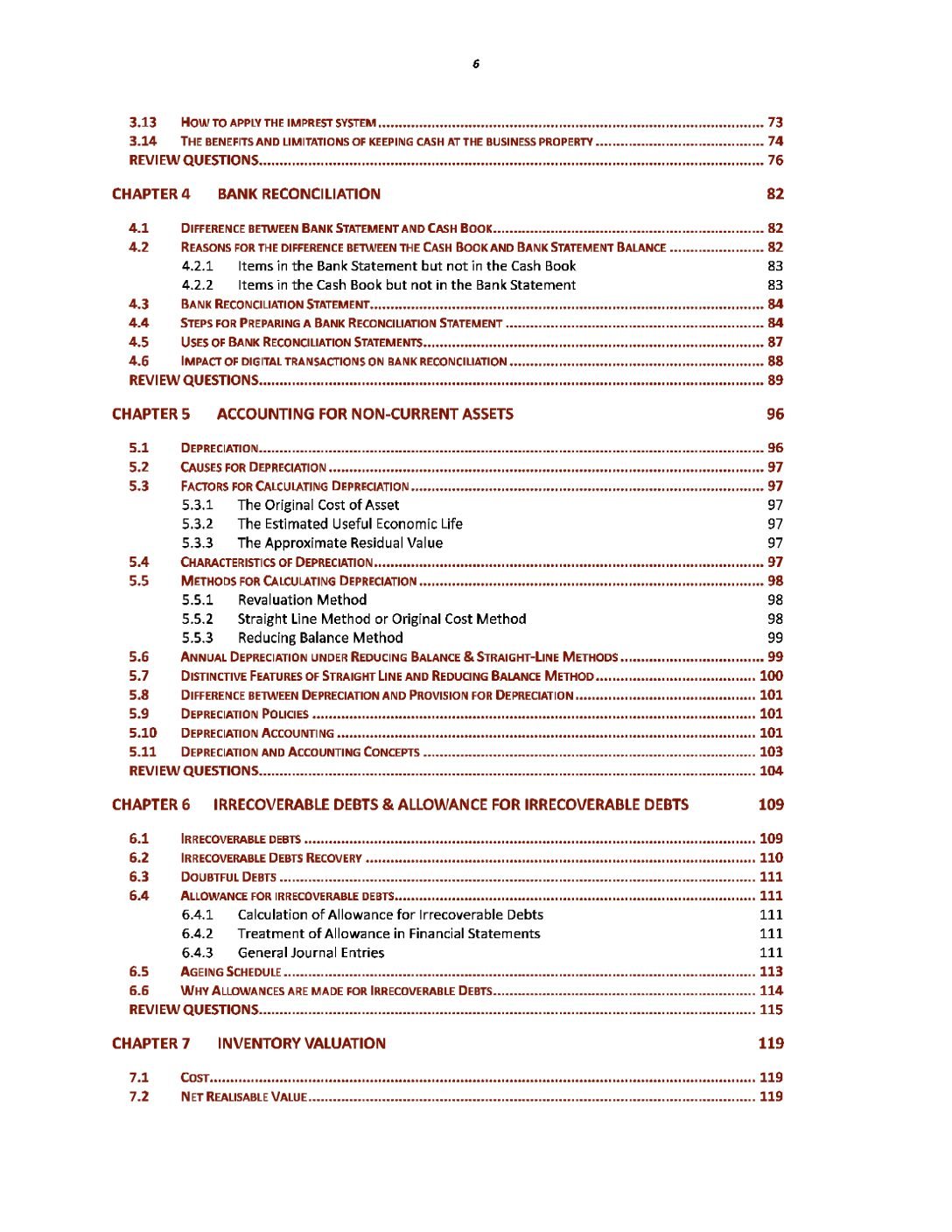

CHAPTER 7 INVENTORY VALUATION

7.1 COST

7.2 NET REALISABLE VALUE

7.3 BASIS FOR INVENTORY VALUATION

7.4 INVENTORY VALUATION AND ACCOUNTING CONCEPTS

7.5 SEPARATE VALUATION OF INVENTORY ITEMS

7.6 EFFECTS OF ERRORS IN VALUING INVENTORY

REVIEW QUESTIONS

CHAPTER 8 CAPITAL AND REVENUE EXPENDITURE AND RECEIPTS

8.1 TREATMENT OF CAPITAL AND REVENUE ITEMS IN FINANCIAL STATEMENT

8.2 DISTINCTION BETWEEN CAPITAL AND REVENUE EXPENDITURES

8.2.1 Expenditures for Acquisition of a Non-current asset

8.2.2 Expenditures for Improving Efficiency /Capacity of a Non-current asset

8.2.3 Expenditure at the Initiation of Business

8.2.4 Expenditure on Extension of Business

8.2.5 Expenditures to Increase the Useful Life of an Asset

8.2.6 Expenditures of Abnormal Amounts

8.3 APPLICATION OF MATERIALITY CONCEPT

8.4 DIFFERENCE BETWEEN CAPITAL AND REVENUE RECEIPTS

8.4.1 Revenue Receipts

8.4.2 Capital Receipts

8.5 EFFECTS OF WRONG TREATMENT OF CAPITAL AND REVENUE ITEMS

REVIEW QUESTIONS

CHAPTER 9 CORRECTION OF ERRORS

9.1 TYPES OF ERRORS

9.1.1 Errors Not Affecting Agreement of Trial Balance

9.1.2 Errors Affecting Agreement of Trial Balance

9.2 SUSPENSE ACCOUNT

9.3 EFFECT ON PROFIT OF CORRECTING ERRORS

9.4 EFFECTS ON STATEMENT OF FINANCIAL POSITION OF CORRECTING ERRORS

REVIEW QUESTIONS

CHAPTER 10 CONTROL ACCOUNTS

10.1 CONTROL ACCOUNTS IN CAMBRIDGE ORDINARY LEVEL SYLLABUS

10.2 THE FORMAT OF CONTROL ACCOUNTS

10.3 BOOKS OF PRIME ENTRY AS SOURCES OF CONTROL ACCOUNTS ENTERIES

10.4 CONTRA ENTRY

10.5 TWO BALANCES OF CONTROL ACCOUNTS

10.5.1 Reasons for Having Two Balances of a Control Account

10.5.2 Treatment of Two Balances in the Statement of Financial Position

10.6 BENEFITS OF OFFERING CASH DISCOUNTS

10.7 EFFECTS OF CHARGING INTEREST ON OVERDUE BALANCES OF CUSTOMERS

10.8 ADVANTAGES OR USES OF CONTROL ACCOUNTS

10.9 IMPACT OF DIGITAL ACCOUNTING ONN CONTROL ACCOUNTS

REVIEW QUESTIONS

CHAPTER 11 OTHER PAYABLES AND OTHER RECEIVABLES

11.1 Matching Costs and Revenues

11.2 Accruals

11.2.1 Accrued Expenses (Other Payables)

11.2.2 Accrued Incomes (Other Receivables)

11.3Prewvyments

11.3.1 Prepaid Expenses [Other Receivables)

11.3.2 Pre-received Incomes/Incomes in Advance

11.4 Treatment of Opening Accruals or preravments

11.5 Application of Matching Concept by Using Accruals and Prepayments

REVIEW QUESTIONS

CHAPTER 12 SOLE TRADERS

12.1 SOLE TRADER

12.1.1 Advantages of Operating as a Sole Trader

12.1.2 Disadvantages of Operating as a Sole Trader

12.2 Need for Statement of profit or loss

12.3 Uses of statement of profit or loss

12.4 Carriage Inwards

12.5 Carriage Outwards

12.6 Financial Statements – An important consideration

12.7 Accounting Period

12.8 Drawings

12.9 Assets

12.9.1 Non-Current Assets

12.9.2 Current Assets

12.10 LIABILITIES

12.10.1 Current Liabilities

12.10.2 Non-Current Liabilities

12.11 Cash and Accrual Basis of Accounting

12.12 Need for Adjustments

12.13 Types of Adjustments

12.13.1 Inventory at Year-End

12.13.2 Closing Inventory in Trial Balance

12.13.3 Drawings by Owner

12.13.4 Other Receivables and Payables

12.13.5 Depreciation

12.13.6 Irrecoverable debts

12.13.7 Allowance for irrecoverable debts

12.14 The Versatility of Sole Trader Businesses

12.15 Calculation of Profits for Service Businesses

12.16 Calculation of Profits for a Trading and a Service Business

REVIEW QUESTIONS

CHAPTER 13 PARTNERSHIPS

13.1 The Versatility of Partnerships

13.2 Advantages and Disadvantages of the Partnership

13.3 Partnership Agreement

13.3.1 Contents of Partnership Agreement

13.4 Provision of Partnership Act 1890 in the Absence of Partnership Deed

13.5 Financial Statements of a Partnership

13.5.1 Appropriations of Profit

13.5.2 Statement of Financial Position of Partnership

13.6 Accounting Records for Partners

13.6.1 Partners’Capital Accounts

13.6.2 Benefits (Uses) of Having Separate Capita I Accounts

13.6.3 Benefits (Uses) of Having Separate Current Accounts

13.6.4 Reasons for Keeping Separate Partners’ Capital and Current Account

13.6.5 Drawings Accounts

13.7 Partners’ Loan Account

13.7.1 Reasons for Partners’ loans in addition to Capital Accounts

13.8 Interest on Capital

13.9 Interest on Drawings

REVIEW QUESTIONS

CHAPTER 14 LIMITED COMPANIES

14.1 The Need for Companies

14.2 The Versatility of Limited Companies

14.3 Advantages and Disadvantages of Forming a Limited Company

14.3.1 Advantages of a Company

14.3.2 Disadvantages of Forming a Limited Company

14.4 Sources of Finance for a Commny

14.5 Types of Shares

14.5.1 Ordinary Shares

14.5.2 Preference Shares

14.6 Debentures

14.7 Share Capital

14.8 Financial Statements of Limited Companies

14.9 Distribution of Profits

14.9.1 Ordinary Dividend

14.9.2 Transfer to General Reserve

14.9.3 Retained Profits

14.10 Statementof Changes in Equity

14.11 Statementof Financial Position

14.12 A Comparison of Financial Statements of Business Organisations

REVIEW QUESTIONS

CHAPTER 15 INCOMPLETE RECORDS

15.1 The Reasons for Incomplete Records

15.2 Need for Premring Financial Statements from Incomplete Records

15.3 Calculating Profits and Losses from Changes in Capital/Net Assets

15.3.1 Statement of Affairs

15.3.2 Statement to Calculate Profit or Loss

15.4 Preparation of Financial Statements from Incomplete Records

15.4.1 Calculation of Opening Capital through Statement of Affairs

15.4.2 Preparation of Cash/Bank Account

15.4.3 Calculation of Total Sales

15.4.4 Calculation of Total Purchases

15.5 Mark-Up and Margin

15.5.1 Use of Mark up and Margin to Calculate Missing Items in Trading Section

15.5.2 Conversion of Mark-up into Margin

15.5.3 Conversion of Margin into Mark-up

15.6 Calculation of Incomes/Expenses to be shown in Statement of Profitor Loss

15.7 Calculation of Depreciation

15.8 Premring Statement of Financial Position from Incomplete Records

15.9 Advantages of Accounts Prepared from Incomplete Records

15.10 Disadvantages or Defects of Accounts Prepared from Incomplete Records

REVIEW QUESTIONS

CHAPTER 16 CLUBS AND SOCIETIES

16.1 Comparison between Profit and Non-Profit Making Organisations

16.2 Incomes and Expenses of Clubs and Societies

16.2.1 Incomes of Clubs and Societies

16.2.2 Expenses of Clubs and Societies

16.3 Some Peculiar Terms of Clubs and Societies

16.3.1 Life Subscription

16.3.2 Legacy

16.3.3 Gift

16.3.4 Grants and Donations

16.4 Accounting by clubs and Societies

16.4.1 Receipts and Payments Account

16.4.2 Income and Expenditure Account

16.4.3 Differences between Receipts and Payment A/c & Income and Expenditure A/c

16.4.4 Trading Account

16.4.5 Income and Expenses on Same Head

16.5 Calculation of Incomes/Expenses to be shown in Statement of Profitor Loss

16.5.1 Accounting for Subscriptions

16.6 Preparation of Financial Statements

REVIEW QUESTIONS

CHAPTER 17 MANUFACTURING ACCOUNTS

17.1 Direct Costs (Prime Cost)

17.1.1 Raw Materials Cost

17.1.2 Direct Labour Cost

17.1.3 Other Direct expenses

17.2Indirect Costs (Factory Overheads)

17.3 Purpose of Manufacturing Accounts

17.4 Statement of Profit or Loss

17.5 Statement of Financial Position

REVIEW QUESTIONS

CHAPTER 18 ACCOUNTING RATIOS

18.1 Accounting Ratios

18.2 Analysis of Ratios

18.2.1 Comparing one year with another (Trend or Time Series Analysis)

18.2.2 Comparing One Business with another Business (Inter-firm Comparison)

18.3 Demonstration of ratios

18.4 Profitability Ratios

18.4.1 Gross Profit Margin

18.4.2 Profit Margin

18.4.3 Return on Capital Employed (ROCE)

18.5 Liquidity Ratios

18.5.1 Current Ratio

18.5.2 Acid Test (Liquid) Ratio

18.6 Efficiency Ratios

18.6.1 Rate of Inventory Turnover

18.6.2 Trade Receivables’Turnover (days)

18.6.3 Trade payables’Turnover (days)

18.7 The Difference between Cash and Profit

18.8 Factors affecting the ratios of Two Businesses

18.9 Problems of Inter-firm Comparison

REVIEW QUESTIONS

CHAPTER 19 INTERESTED PARTIES

19.1 Owners

19.2 Managers

19.3 Employees

19.4 Bank

19.5 Investors and lenders

19.6 Suppliers

19.7 Customers

19.8 Government/Tax authorities

19.9 Club members

19.10 Public

19.11 Environmental bodies

REVIEW QUESTIONS

CHAPTER 20 LIMITATIONS OF ACCOUNTING STATEMENTS

20.1 Historical Cost

20.1.1Over/Understatement of Assets

20.1.2 Inaccurate representation

20.1.3 Inflation and Currency Fluctuations

20.2 Application of Accounting Policies

20.2.1 Subjectivity

20.2.2 Estimates and Judgments

20.2.3 Manipulation Risk

20.2.4 Lack of Comparability

20.2.5 Inconsistencies

20.3 Non-Financial Aspects

20.3.1 Intangible Assets

20.3.2 External Factors

20.3.3 Sustainability and Social Impact

20.3.4 Incomplete Picture

REVIEW QUESTIONS

CHAPTER 21 ACCOUNTING CONCEPTS

21.1 Conventions and Concepts – An Implication

21.2 Business entity Concept

21.3 Consistency Concept

21.4 Duality Concept

21.5 Going Concern Concept

21.6 Historic Cost Concept

21.7 Materiality Concept

21.8 Money Measurement Concept

21.9 Prudence Concept

21.10 Realisation Concept

21.11 Accrual Concept

21.12 Matching Concept

21.13 Realisation, Accrual and Matching Concepts Compared

REVIEW QUESTIONS

CHAPTER 22 ETHICAL CONSIDERATIONS

22.1 Ethics Relating to the Practice of Accounting

22.2 Professional Ethics

22.3 What is Ethical?

22.4 Fundamental Ethical Principles

22.4.1 Integrity

22.4.2 Objectivity and Independence

22.4.3 Professional Competence and Due Care

22.4.4 Confidentiality

22.4.5 Professional Behaviour

22.5 The Problems of Poor ethics in accounting

22.6 Impact of ethical behaviour on stakeholders

22.7 Impact of ethical behaviour on society

22.8 Ethical Conflict

REVIEW QUESTIONS

CHAPTER 23 TECHNOLOGY AND SUSTAINABILITY

23.1 The use of digital applications for accounting records

23.1.1 Digital Applications

23.1.2 Benefits of Digital Accounting

23.2 What is Accou nting Data?

23.2.1 Why is Accounting Data Important?

23.3 WHY STORE ACCOU NTING DATA SAFELY AND SUSTAINABLY?

23.4 Risks of Not Storing Accounting Data Safely

23.5 Risks of Not Storing Accounting Data Sustainably

23.6 Types of Storage Systems

23.6.1 Manual Storage Systems

23.6.2 Data Storage Devices

23.6.3 Cloud Storage Services

23.6.4 Other Digital Services

REVIEW QUESTIONS

SOLUTION TO ODD-NUMBERED QUESTIONS

CHAPTER 1A—–317

CHAPTER IB—–318

CHAPTER 1C—–322

CHAPTER ID—–325

CHAPTER 2—–327

CHAPTER 3—–331

CHAPTER 4—–332

CHAPTER 5—–334

CHAPTER 6—-339

CHAPTER 7—–342

CHAPTER 8—–343

CHAPTER 9—–344

CHAPTER 10—–347

CHAPTER 11—–350

CHAPTER 12—–350

CHAPTER 13—–357

CHAPTER 14—–361

CHAPTER 15—–364

CHAPTER 16—–367

CHAPTER 17—–371

CHAPTER 18—–374

CHAPTER 19—–379

CHAPTER 20—–379

CHAPTER 21—–380

CHAPTER 22—–380

CHAPTER 23—–381

KEY TO EVEN-NUMBERED QUESTIONS INDEX

You must be logged in to post a review.

Reviews

There are no reviews yet.