| Book Code : | 101 |

|---|---|

| Subject Code : | 7707/0452 |

| Author : | M. Nauman Malik |

| Years Covered: | May/June 2000 To March 2025 |

| Publishers : | Read and Write Publications |

Description

101 Accounting O Level/IGCSE MCQ’S Paper 1

Cambridge University has adopted MCQs as a part of O Level Accounting 7110 Examinations since 2000. Now almost 33.3% of weightage is allocated to MCQs.

Each topic of the syllabus has been covered in a separate chapter containing MCQs from the past papers. All the MCQs in this Book have been compiled according to the May June or October November year in which they were set in the O Level Cambridge examinations updated till 2020.

For the better understanding of the questions detailed answers are also given at the end of each chapter. CAIE Students will find “Student Evaluation Card” quite useful. This will enable them to compare their performances and focus on the weaker areas.

The correct answers to the Questions are given in the answer key at the end of each chapter.

In the current edition Financial statements of sole traders has been subdivided into four topics so that students may focus on each sub topic independently.

Now you can place order for this book in both paperback and ebook format. ebooks are for online reading and these are not pdf files to download. The purchaser is granted a single, nontransferable license for his or her personal use of the E-book on digital media for the period of one year from the date of purchase.

The purchaser is not authorized to grant access to the E-book, in whole or in part, to any third party, in particular, to sublicense, to transfer, to timeshare, or to rent out the E-book.

Making the E-book available on the Internet or in other networks, reselling the E-book, and/or any use for commercial purposes is not permitted

101 Accounting O Level/OGCSE MCQ’S Paper 1

- All Variants

- Solved with explanation of all choices A,B,C & D

- Questions order from new to old

- Each Chapter has been classified into sub topics

TABLE OF CONTENTS

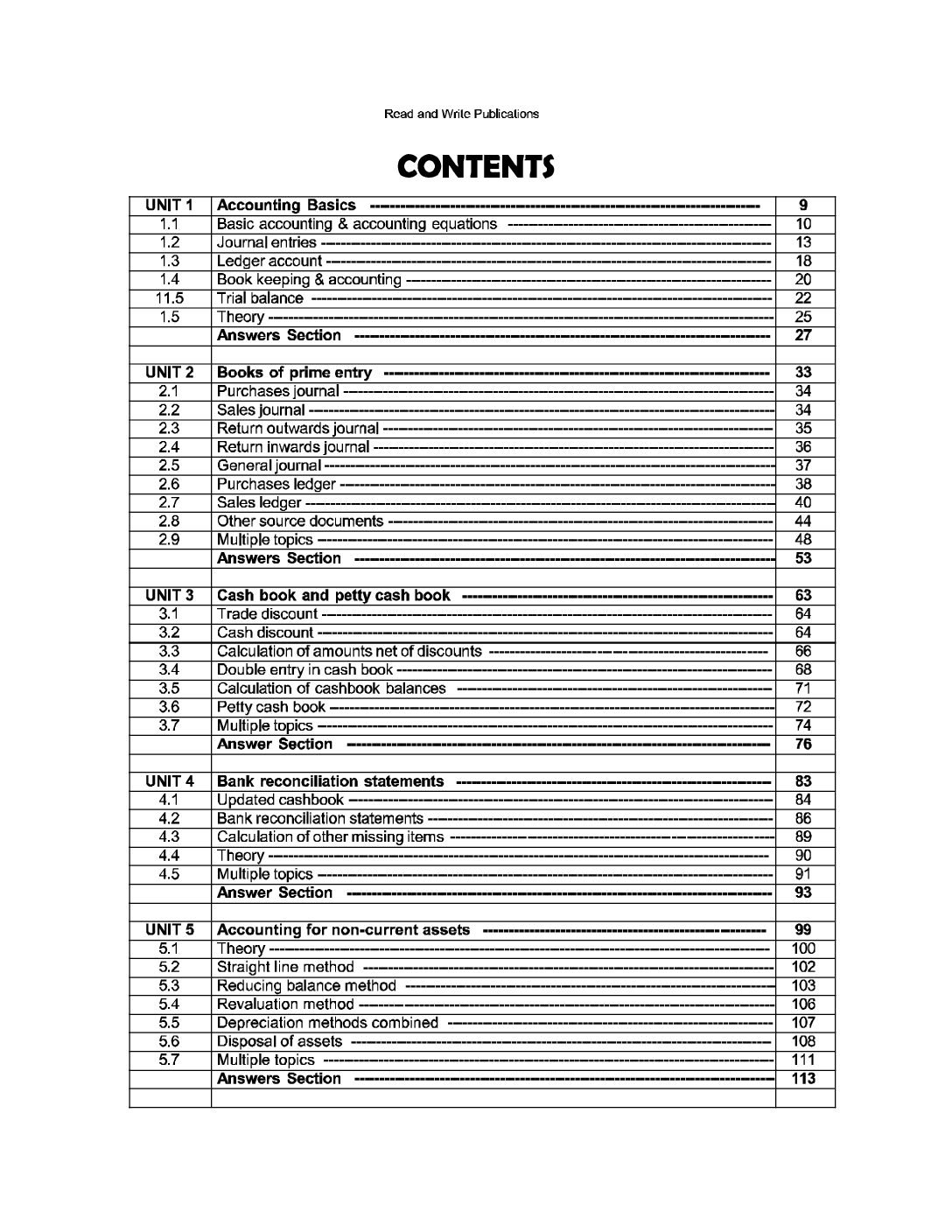

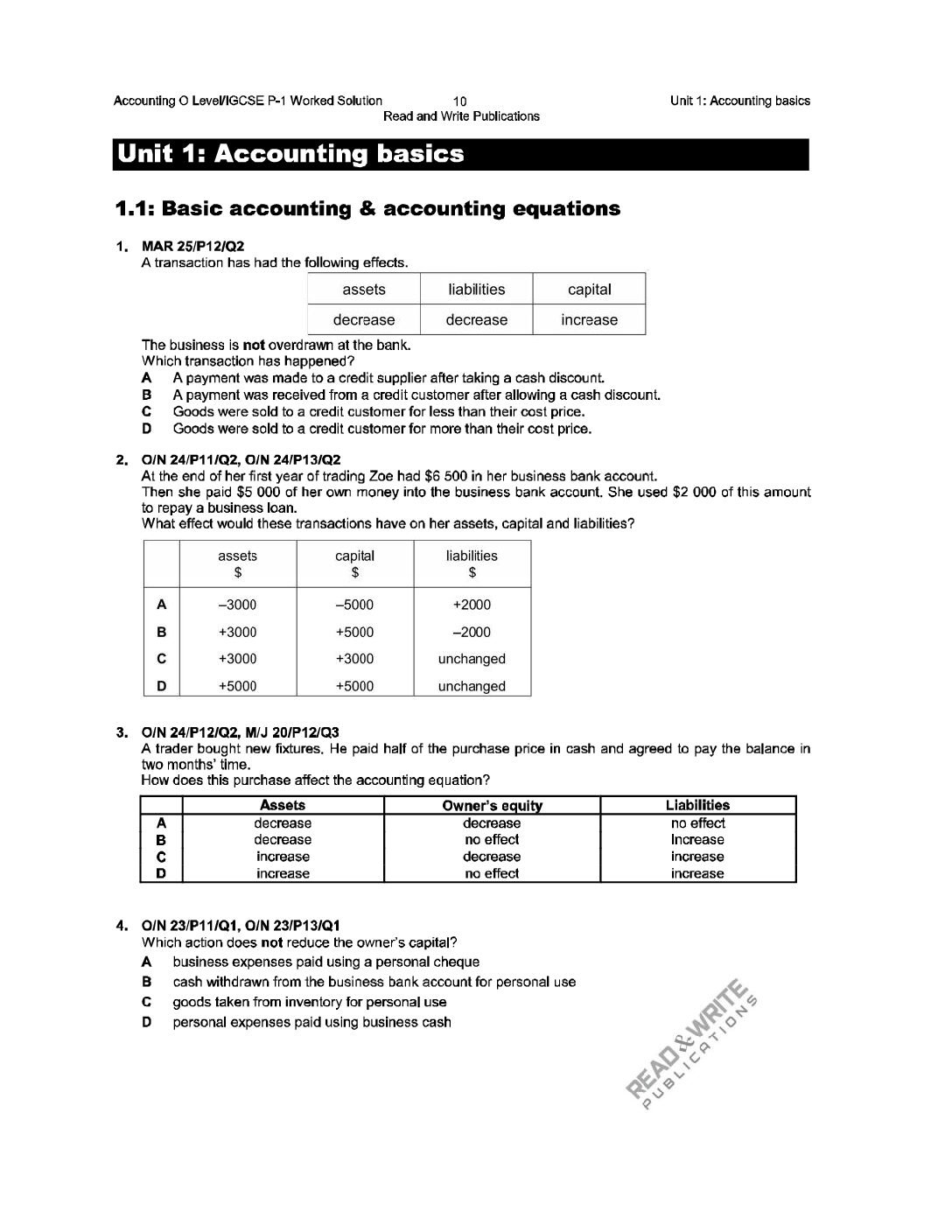

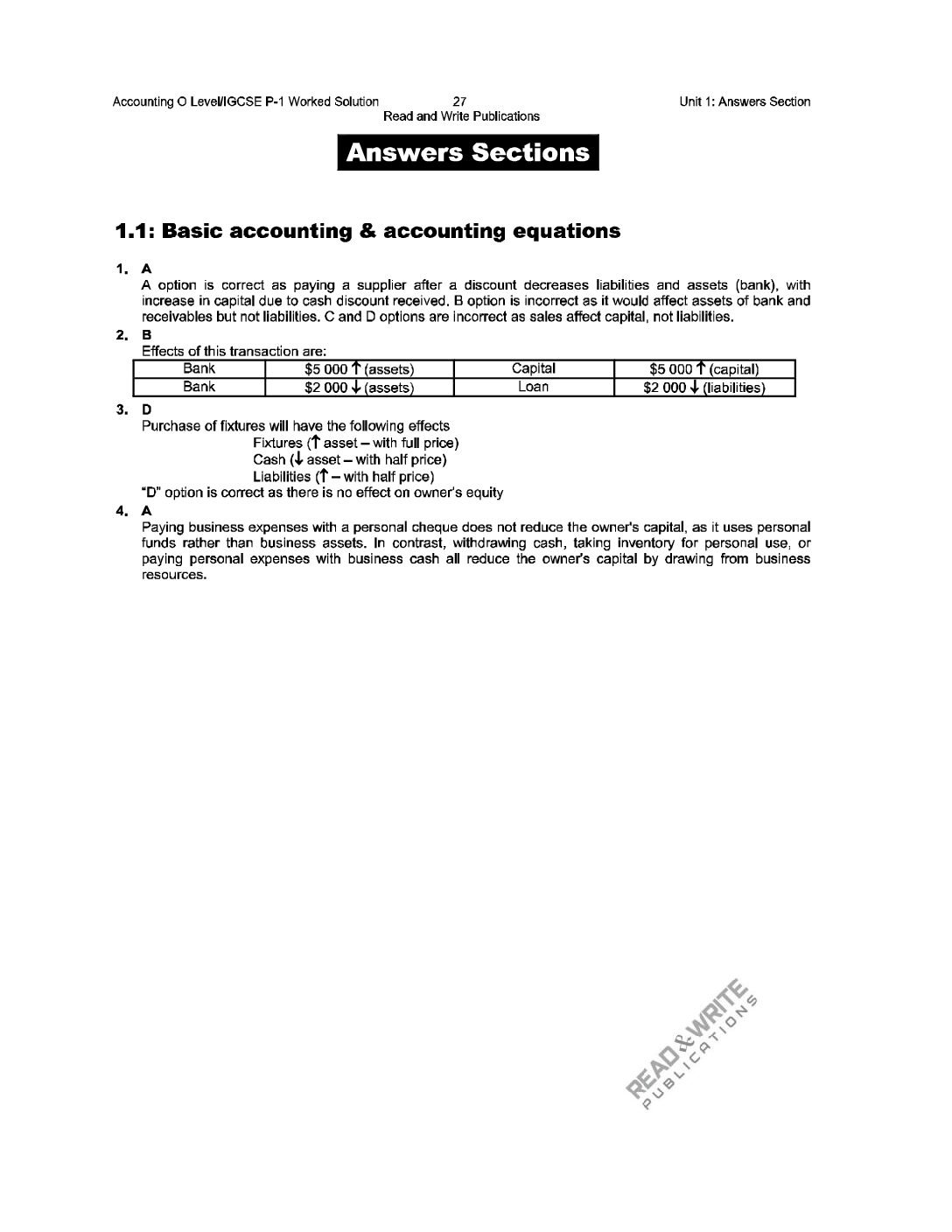

CHAPTER 1 ACCOUNTING BASICS

1.1: BASIC ACCOUNTING & ACCOUNTING EQUATIONS

1.2: JOURNAL ENTRIES

1.3: LEDGER ACCOUNTS

1.4: BOOK KEEPING & ACCOUNTING

1.5: TRAIL BALANCE

1.6: THEORY

ANSWER SECTION

CHAPTER 2 BOOKS OF PRIME ENTRY

2.1: PURCHASES JOURNAL

2.2: SALES JOURNAL

2.3: RETURN OUTWARDS JOURNAL

2.4: RETURN INWARDS JOURNAL

2.5: GENERAL JOURNAL

2.6: PURCHASES LEDGER

2.7: SALES LEDGER

2.8: OTHER SOURCE DOCUMENTS

2.9: MULTIPLE TOPICS

ANSWER SECTION

CHAPTER 3 CASH BOOK AND PETTY CASH BOOK

3.1: TRADE DISCOUNT

3.2: CASH DISCOUNT

3.3: CALCULATION OF AMOUNTS NET OF DISCOUNTS

3.4: DOUBLE ENTRY IN CASH BOOK

3.5: CALCULATION OF CASH BOOK BALANCES

3.6: PETTY CASH BOOK

3.7: MULTIPLE TOPICS

ANSWER SECTION

CHAPTER 4 BANK RECONCILIATION STATEMENTS

4.1: UPDATED CASHBOOK

4.2: BANK RECONCILIATION STATEMENTS

4.3: CALCULATION OF OTHER MISSING ITEMS

4.4: THEORY

4.5: MULTIPLE TOPICS

ANSWER SECTION

CHAPTER 5 ACCOUNTING FOR NON-CURRENT ASSETS

5.1: THEORY

5.2: STRAIGHT LINE METHOD

5.3: REDUCING BALANCE METHOD

5.4: REVALUATION METHOD

5.5: DEPRECIATION METHODS COMBINED

5.6: DISPOSAL OF ASSETS

5.7: MULTIPLE TOPICS

ANSWER SECTION

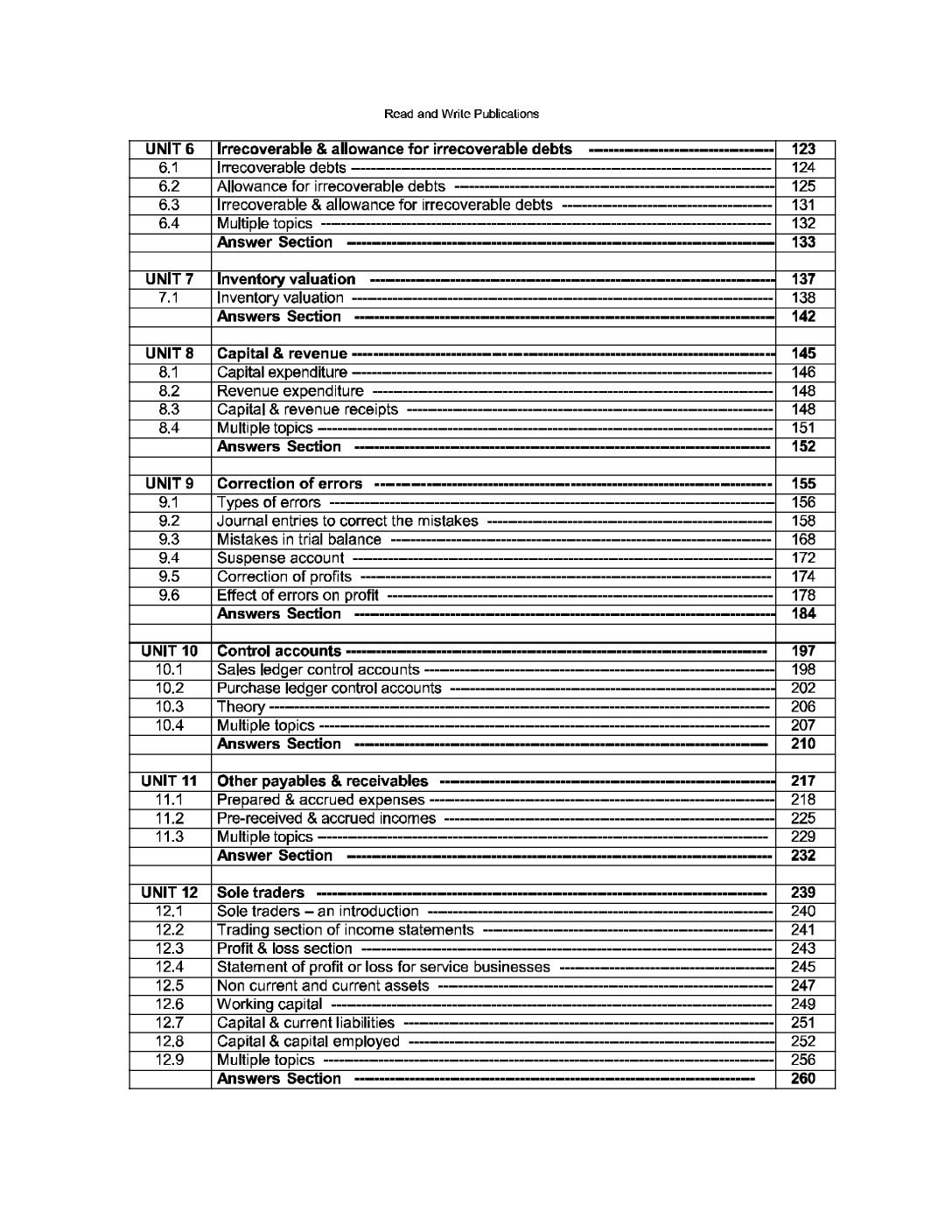

CHAPTER 6 IRRECOVERABLE DEBTS & PROVISION FOR DOUBTFUL DEBTS

6.1: IRRECOVERABLE DEBTS

6.2: ALLOWANCE FOR IRRECOVERABLE DEBTS

6.3: IRRECOVERABLE & ALLOWANCE FOR IRRECOVERABLE DEBTS

6.4: MULTIPLE TOPICS

ANSWER SECTION

CHAPTER 7 INVENRORY VALUATION

7.1: INVENTORY VALUATION

ANSWER SECTION

CHAPTER 8 CAPITAL & REVENUE

8.1: CAPITAL EXPENDITURE

8.2: REVENUE EXPENDITURE

8.3: CAPITAL & REVENUE RECEIPTS

8.4: MULTIPLE TOPICS

ANSWER SECTION

CHAPTER 9 CORRECTION OF ERRORS

9.1: TYPES OF ERROR

9.2: JOURNAL ENTERIES TO CORRECT THE MISTAKES

9.3: MISTAKES IN TRAIL BALANCE

9.4: SUSPENSE ACCOUNT

9.5: CORRECTION OF PROFITS

9.6: EFFECTS OF ERRORS ON PROFITS

ANSWERS SECTION

CHAPTER 10 CONTROL ACCOUNTS

10.1: SALES LEDGER CONTROL ACCOUNTS

10.2: PURCHASE LEDGER CONTROL ACCOUNTS

10.3: THEORY

10.4: MULTIPLE TOPICS

ANSWERS SECTIONS

CHAPTER 11 OTHER PAYABLES & RECIEVABLES

11.1: PREPARED & ACCURED EXPENSES

11.2: PRE-RECEIVED & ACCURED INCOMES

11.3: MILTIPLE TOPICS

ANSWER SECTION

CHAPTER 12 SOLE TRADERS

12.1: SOLE TRADERS – AN INTRODUCTION

12.2: TRADING SECTION OF INCOME STATEMENTS

12.3: PROFIT & LOSS SECTION

12.4: STATEMENT OF PROFIT OR LOSS FOR SERVICE BUSINESSES

12.5: NON CURRENT AND CURRENT ASSETS

12.6: WORKING CAPITAL

12.7: CAPITAL & CURRENT LIABILITIES

12.8: CAPITAL & CAPITAL EMPLOYED

12.9: MULTIPLE TOPICS

ANSWER SECTION

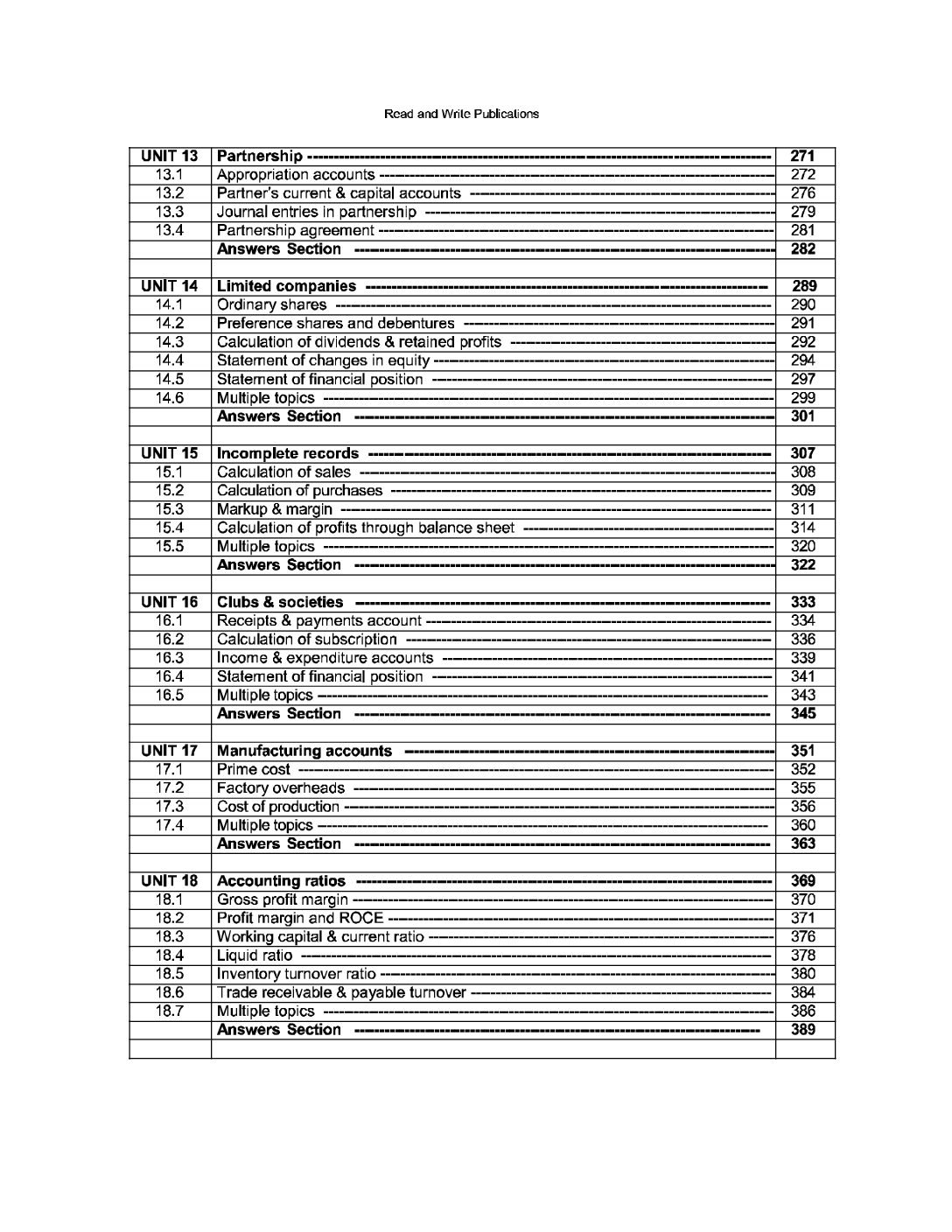

CHAPTER 13 PARTNERSHIP

13.1: APPROPRIATION ACCOUNT

13.2: PARTNERS’ CURRENT CAPITAL ACCOUNTS

13.3: JOURNAL ENTRIES IN PARTNERSHIP

13.4: PARTNERSHIP AGREEMENT

ANSWERS SECTION

CHAPTER 14 LIMITED COMPANIES

14.1: ORDINARY SHARES

14.2: PREFERENCE SHARES & DEBENTURES

14.3: CALCULATION OF DIVIDENDS & RETAINED PROFITS

14.4: STATEMENT OF CHANGES IN EQUITY

14.5: STATEMENT OF FINANCIAL POSITION

14.6: MULTIPLE TOPICS

ANSWERS SECTION

CHAPTER 15 INCOMPLETE RECORDS

15.1: CALCULATION OF SALES

15.2: CALCULATION OF PURCHASES

15.3: MARKUP & MARGIN

15.4: CALCULATION OF PROFITS THROUGH BALANCE SHEET

15.5: MULTIPLE TOPICS

ANSWERS SECTION

CHAPTER 16 CLUBS & SOCIETIES

16.1: RECEIPTS & PAYMENTS ACCOUNTS

16.2: CALCULATIONS OF SUBSCRIPTION

16.3: INCOME & EXPENDITURE ACCOUNTS

16.4: STATEMENTS OF FINANCIAL POSITION

16.5: MULTIPLE TOPICS

ANSWERS SECTION

CHAPTER 17 MANUFACTURING ACCOUNTS

17.1: PRIME COST

17.2: FACTORY OVERHEADS

17.3: COST OF PRODUCTION

17.4: MULTIPLE TOPICS

ANSWERS SECTION

CHAPTER 18 ACCOUNTING RATIOS

18.1: GROSS PROFIT MARGIN

18.2: PROFIT MARGIN & ROCE

18.3: WORKING CAPITAL & CURRENT RATIO

18.4: LIQUID RATIO

18.5: INVENTORY TURNOVER RATIO

18.6: TRADE RECEIVABLE & PAYABLE TURNOVER

18.7: MULTIPLE TOPICS

ANSWERS SECTIONS

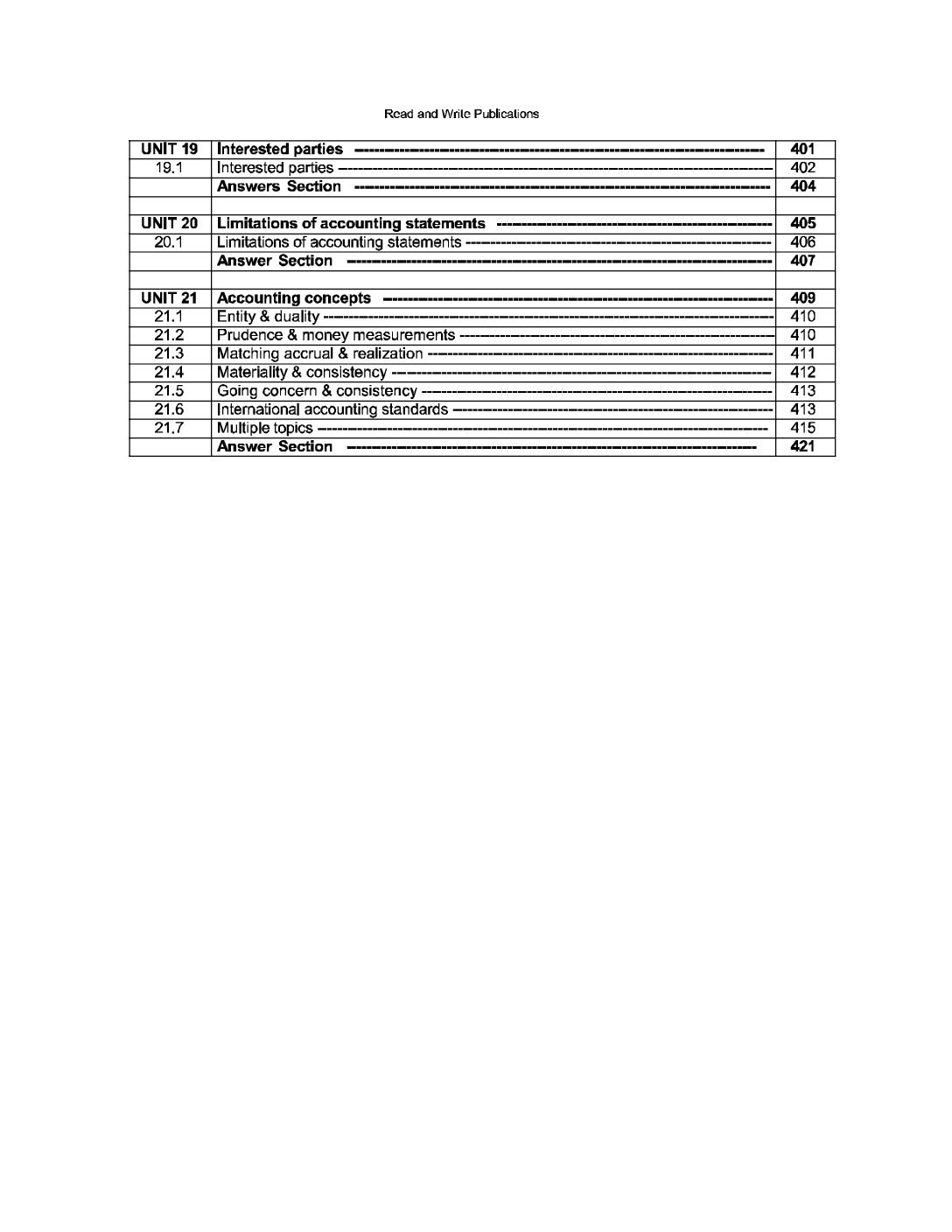

CHAPTER 19 INTRESTED PARTIES

19.1: INTRESTED PARTIES

ANSWERS SECTIONS

CHAPTER 20 LIMITATIONS OF ACCOUNTING STATEMENTS

20.1: LIMITATIONS OF ACCOUNTING STATEMENTS

ANSWER SECTION

CHAPTER 21 ACCOUNTING CONCEPTS

21.1: ENTITY & DUALITY

21.2: PRUDENCE & MONEY MEASUREMENT

21.3: MATCHING, ACCRUAL & REALISATION

21.4: MATERIALITY & CONSISTENCY

21.5: GOING CONCERN & COST

21.6: INTERNATIONAL ACCOUNTING STANDARDS

21.7: MULTIPLE TOPICS

ANSWER SECTION

You must be logged in to post a review.

Reviews

There are no reviews yet.